- HOME

- PR

- NEWS

Prev

POSCO ICT pursues corporate citizenship through a YouTube contest together with the disabledNext

POSCO ICT urged to post continued growth based on proven and highly differentiated businessesPOSCO ICT utilizing AI to identify symptoms of insolvent enterprise in advance

2020.02.27

- AI-based analysis of payment history of National Pension, bid history in public procurement projects, and financial transaction history

- POSCO ICT and e-Credible to launch AI-based credit evaluation service as the first case in Korea

A service utilizing AI to identify the insolvency of a company in advance so that any potential risks are minimized.

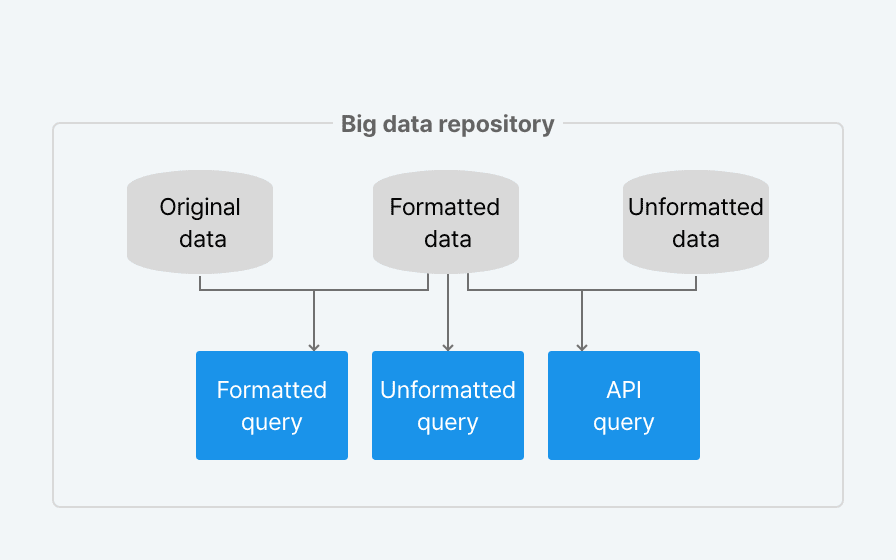

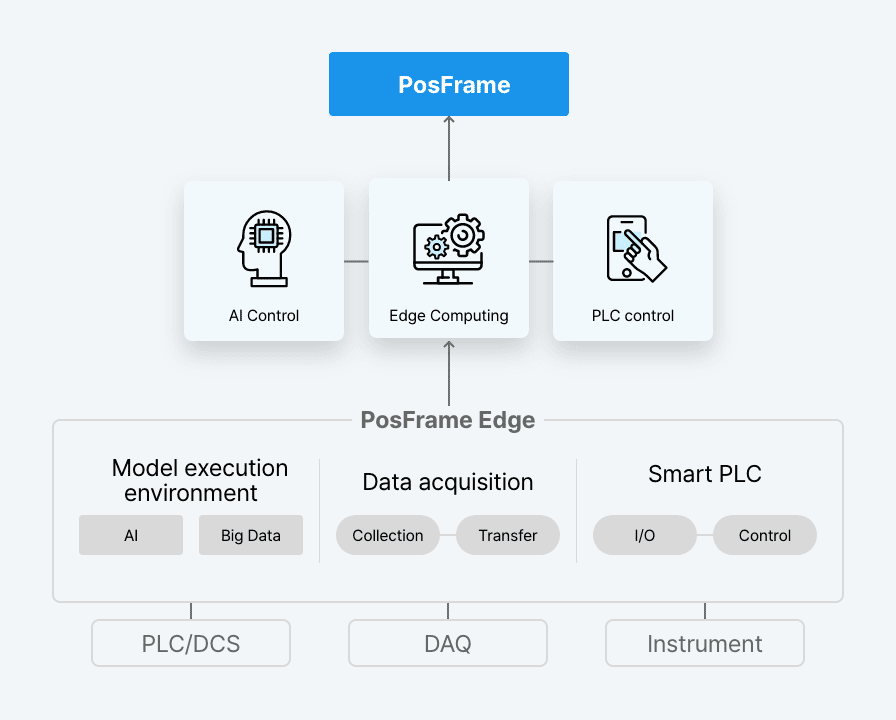

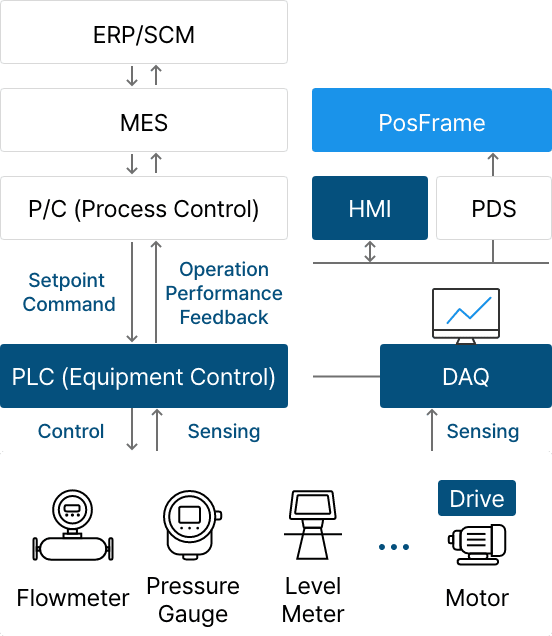

POSCO ICT (President: Son Geon-jae), in collaboration with business credit evaluation provider e-Credible (President: Lee Jin-ok), announced the joint development and launch of “CREDEX (www.credex.co.kr),” the first AI-based business insolvency prediction system in Korea. CREDEX utilizes AI and big data to collect and analyze financial and non-financial data of a company in real time for the prediction of debt redemption and financing capabilities in order to provide the information to customers before the company becomes insolvent.

Companies have been using the credit rating from professional credit agencies in an effort to minimize diverse risks from insolvency of their partners. Nonetheless, the current credit system is limited in terms of predicting insolvency in time as it is based on financial statements, the result of operation of a company showing its yearly and quarterly performances.

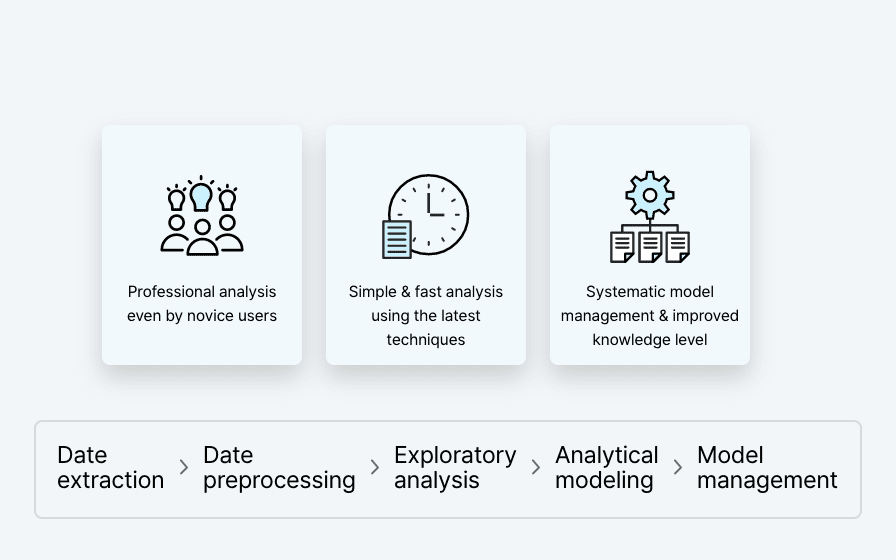

To overcome such limitations, the CREDEX service collects information on various activities in real time including payment history of National Pension, bid history in public procurement projects, and financial transaction history and applies its own AI system to analyze the data to identify any symptoms of insolvency in advance. This allows for a comprehensive assessment of debt redemption capability of the evaluated company and detects changes of its credit status to notify the customer of symptoms of insolvency, including the expected time when the insolvency becomes a reality. The credit ratings are updated on a daily basis, and any change of the ratings can be sent via emails or text message to enable the fastest response by customers of the service.

For example, Company A, which filed for bankruptcy on April 13, 2019, received a credit rating of B+ from other credit rating agencies, but CREDEX set Level 6 for the company -- a risky range -- in January 2019 and predicted insolvency in 3 months. CREDEX is a yearly subscription-based service but also provides the credit report of a target company as requested by the user.

“We came up with this new kind of business insolvency prediction solution combining AI and big data to prosper in this era of the 4th Industrial Revolution. The prediction rate will be improved as we obtain more data related to business management and constantly advance the AI model,” said Cho Yong-sik, the CREDEX team leader.

Meanwhile, Eom Gi-chul, the leader of Credit Verification Division at e-Credible expects customers of the CREDEX service to become aware of the financial risks of their partners and clients in advance for timely response and make the right decision for new business transactions.